Coronavirus And The United States Energy Market

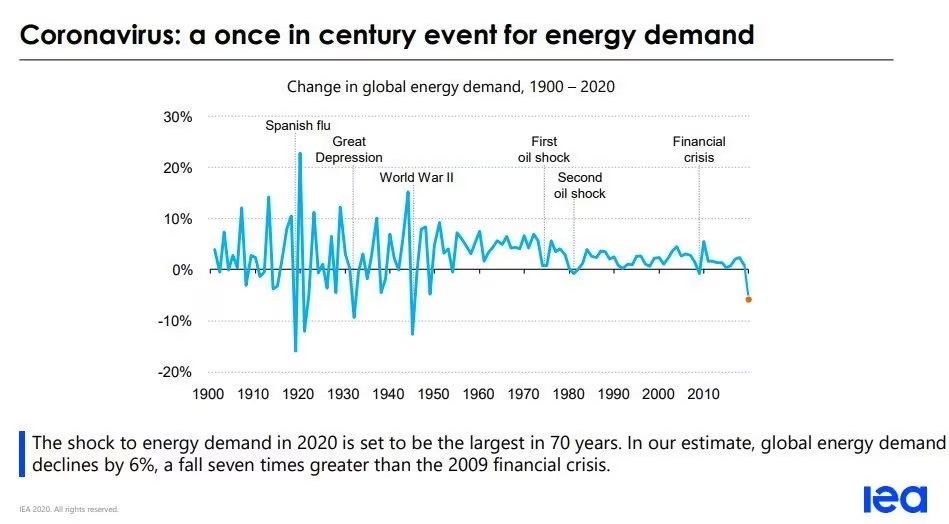

Coronavirus (COVID-19) has sent shock waves through supply chains of every industry worldwide. Since February, this infectious disease has been the cause of cancelled flights, event cancellations and shipping interruptions worldwide. Here we will review how the emergence of COVID-19 is affecting an already depressed US energy market, how the past may provide some insight as to the near-future markets and how current market conditions may impact energy procurement decisions.

Prior to the outbreak of COVID-19, natural gas, the primary fuel source of electricity generation and heating in the United States, had already reached its lowest price point since 2016. In 2016, prices bottomed out at $1.63/MMBTU due to a global oil supply glut and a weak demand caused by a mild 2016 winter and OPEC policies. Now in early 2020, we have another mild winter driving down demand of natural gas and an ongoing reduction of global activity due to this novel coronavirus, resulting in prices of natural gas dipping to lows of $1.684/MMBTU on the last day of February.

Looking back in recent history, we can see how outbreaks of human coronaviruses can affect national GDP. In 2003 there was a SARS coronavirus outbreak in China and Hong Kong. Economic growth slowed with schools, manufacturers and cargoes curtailing operations, thus reducing energy demand. Demand reductions intensified in February and March and demand steadily continued to decline in smaller increments during the Spring and early Summer months. These impacts to GDP lingered until December 2003. While the 2003 SARS Coronavirus and the COVID-19 have different rates of transmission, detection and mortality, we can look to the past to see how this outbreak may affect us again.

So what does this mean for your natural gas and electricity buying decisions? As natural gas is the primary energy source for electricity generation, the price of retail electricity tends to correlate with the shifts in natural gas costs. During this downturn in natural gas prices, business owners and savvy ratepayers may be able to save on electricity and heating costs. It is uncertain how long this dip in prices may last so now is a good time to evaluate your natural gas and electricity contracts.