New Jersey Solar: What Are My Options?

Why should businesses go solar in New Jersey?

By participating in the New Jersey solar program, organizations can receive cheaper renewable energy that can increase the value of their property.

Commercial solar has a long track record across the United States of reducing organization’s operational costs and meeting sustainability goals. Titan Energy makes sure these agreements are the right fit for your organization and work in conjunction with your competitive electricity contract, allowing for stacked benefits and easy integration.

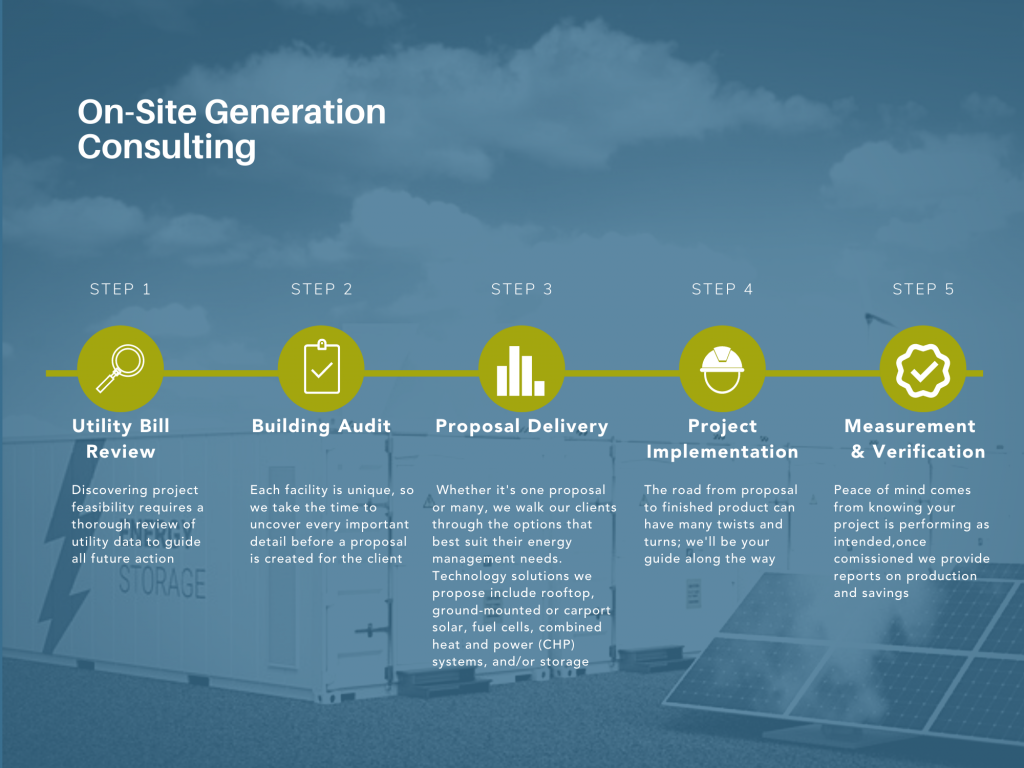

How does Titan help?

What are the solar incentives in New Jersey?

As one of a handful of states to have installed more than one gigawatt of solar capacity, New Jersey has some of the best solar incentives in the country. Two of the state’s core programs – New Jersey net metering and Transition Renewable Energy Certificates (TRECs) – reward property owners for opting to go solar.

- New Jersey Net Metering: This policy allows property owners to sell excess electricity back to the grid at the retail rate, as opposed to the significantly lower wholesale rate that large power plants receive for the electricity they sell to the utility. Jersey Central Power & Light (JCP&L) and PSE&G offer net metering programs in New Jersey.

- Transition Renewable Energy Certificates (TRECs): For every megawatt-hour (MWh) of solar power a solar energy system produces, it also generates one TREC. These TRECs can then be sold to utilities to help them meet the New Jersey Renewable Portfolio Standard. Though the prices for TREcs vary depending on the type of system that’s been installed, homeowners with residential rooftop or ground-mounted solar systems can earn $91.20 per TREC.

New Jersey has also granted a variety of tax breaks to property owners to help keep the cost of solar down.

- Solar Sales Tax Exemption: New Jersey offers residents a full tax exemption on the purchase of all solar energy equipment, including inverters and racking.

- Property Tax Exemption: Similarly, New Jersey residents who invest in a solar energy system will not have to pay any additional property taxes on the value that their solar panels are adding to their homes.

Federal Investment Tax Credit (ITC): The ITC reduces the cost of a solar energy system by 26 percent for anyone who has purchased the system through a cash purchase or solar loan, and has enough income for the tax credit to be relevant.

Who is solar open to? What are the requirements?

New Jersey’s solar program is open to ratepayers located in the service territory of one of the four electric distribution companies: PSE&G, JCP&L, Atlantic City Electric or Rockland Electric. Each solar developer has specific customer criteria that Titan Energy will help you navigate, including credit rating requirement, usage, and utility rate class assignment. We take all factors into consideration before matching you with the right developer.

Once signing an agreement with a chosen developer, the system will be permitted, installed and the production credits will flow to your utility bill.To maximize savings, it is recommended that your competitive supply charges be consolidated into one monthly invoice from your local utility, a process that Titan Energy manages.

How Much Does Solar in New Jersey Cost?

Rooftop solar installation costs in New Jersey, on a cost per watt ($/W) basis are between $2.44 and $3.30 after rebates and tax credits. So a 250kW commercial rooftop solar system will cost your organization anywhere between $610,000 to $825,000.

Obviously these are high costs and the return on your investment will take between 2 to 6 years. So that is why there are creative solar financing programs as well as community solar programs that allow organizations to reap the benefits of solar (low, fixed power costs and supporting renewable energy) all without any equipment on your roof.

Factors that affect New Jersey solar panel costs:

- The size of the solar energy system

- The price of the materials needed for installation

- Labor and overhead costs from your installer

- Maintenance fees

- The cost and average power usage on your current electric bills

- What you can expect to save on future bills

Types of financial products:

Solar Loan

Power Purchase Agreement (PPA)

Lease

Community Solar Agreements

- Fixed Discount: Also referred to as a “floating discount program,” the provider is offering a specific percentage discount off the full value of the net metering credit. It allows for the value of the credit to change but the discount is guaranteed for the life of the agreement. This is a great way to ensure constant savings as the value of the credit changes each year.

- Fixed Rate: This program offers a fixed rate for the credit that flows to your energy bill. This contract style typically offers greater savings for the credit buyer but comes with some degree of risk in terms of the credit values falling below the credit cost.

How Titan Energy Helps You Navigate Options

Titan Energy is an independent energy consulting firm, with in-depth knowledge of energy procurement, demand-side management, and renewable generation services operating in all competitive markets throughout the United States. Titan Energy creates comprehensive energy management strategies utilizing data to control and reduce energy costs. With 20 years of experience navigating complex energy markets and utility programs, Titan helps you determine the best community solar solution for your facility.