Case Study: Sustainable Power, Financial Growth

Challenge

The Town of East Hartford faced the dual challenges of rising energy prices and limited opportunity to reduce energy consumption. Renewable energy emerged as a solution to address both concerns. However, the path to designing a project and issuing an RFP was unclear, and complex incentive programs made the task too difficult to manage with internal resources alone.

Approach and Solution

The Town of East Hartford enlisted the help of CCM’s Renewable Energy Procurement Program, managed by Titan Energy to create a strategy for the Town to participate in the various utility and federal incentive programs that fit the Town’s building and real estate portfolio.

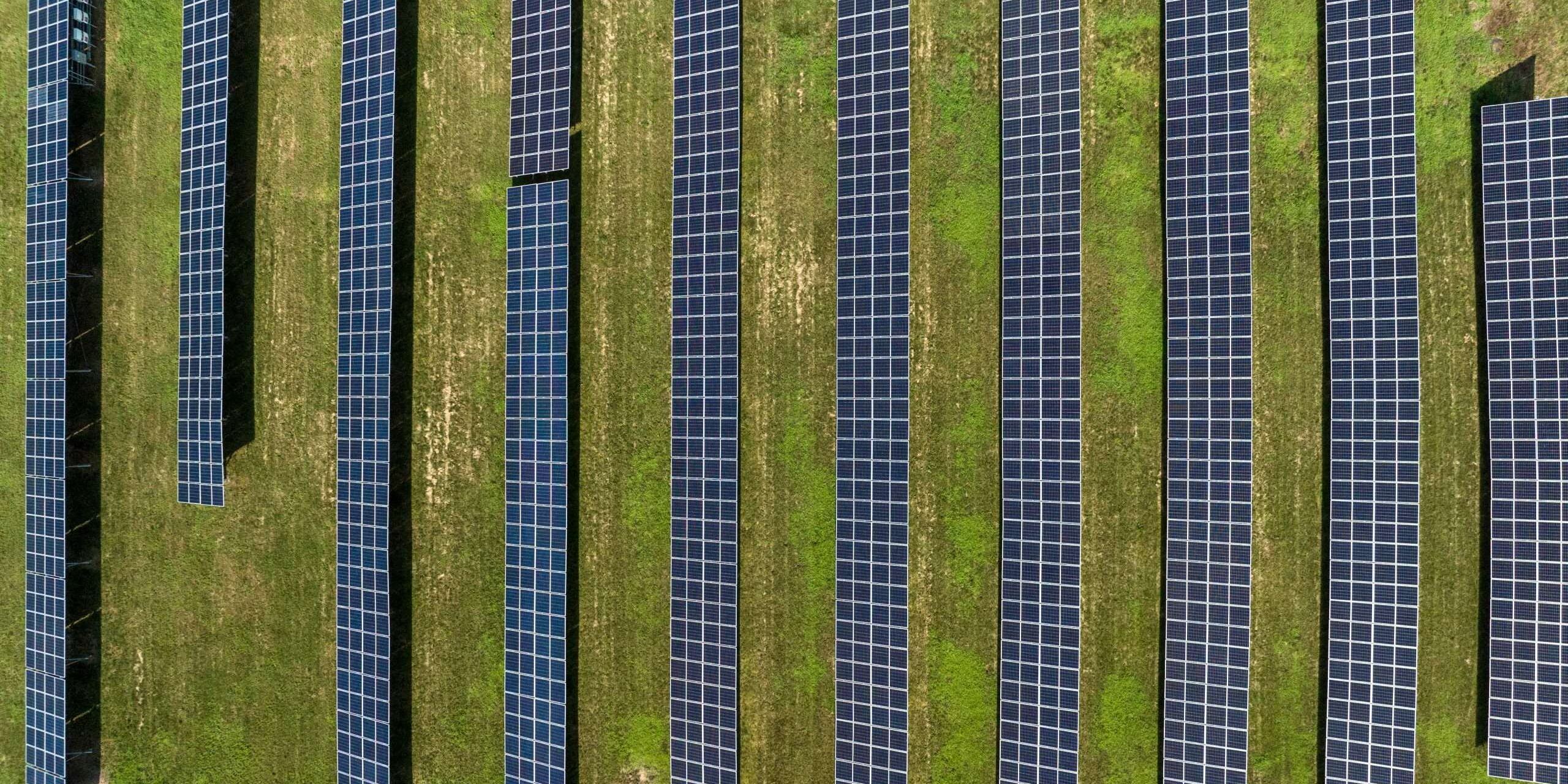

Following an assessment of rooftops, parking lots and open spaces, Titan Energy and Town administrators formulated a phased strategy. The first phase enabled the Town to receive revenue from a large, remotely located solar array, built under the Eversource Non-Residential Renewable Energy Solutions (NRES) program. The second phase utilized the Town’s capped landfill and suitable rooftops under virtual net metering and on-site arrangements.

The NRES program contains a distinct provision to support municipal access to solar’s financial benefits without upfront cost or equipment to install. This provision allows developers to build large-scale solar farms and sell power directly to the utility over 20 years, provided the project has a municipal revenue beneficiary. The municipal beneficiary is entitled to a negotiated share of the top-line revenue from the project. This public policy initiative is specifically designed to ensure the equitable distribution of financial benefits across Connecticut’s towns and cities, with additional incentives designated for “distressed communities” in the state.

During the first phase of the procurement process, Titan Energy located the most advantageous solar projects with a generous revenue streams and high probability of successful development. Projects in Scotland and Woodbury were ultimately selected based on the high probability of successful permitting and development, the quality of the development group associated with the projects, and the total cash value for East Hartford, equal to approximately $3,200,000 over the 20-year contract period.

The second phase of the procurement process remains ongoing.

We Want to Help You

Get in touch to speak to an expert